Understanding Cat S and Cat N Cars: A UK Buyer's Guide

Read about Understanding Cat S and Cat N Cars: A UK Buyer's Guide on chatMOT

Buying a used car in the UK can feel like navigating a maze, especially when encountering vehicles marked as insurance write-offs. Many buyers instantly dismiss cars categorised as Cat S or Cat N, fearing hidden dangers or insurmountable problems.

However, these labels don't always spell disaster. For the informed UK buyer, understanding what 'Cat S' and 'Cat N' truly mean can unlock significant value.

These vehicles, when properly repaired and thoroughly inspected, can represent a smart and economical purchase. This comprehensive guide aims to demystify the world of written-off cars.

We will explain structural versus non-structural damage and evaluate the genuine risks and rewards. You'll learn the essential checks required before purchasing any repaired vehicle.

What 'Insurance Write-Off' Really Means for a Used Car Buyer

The term "insurance write-off" often conjures images of irreparable wreckage, making many used car buyers hesitant. However, this common misconception prevents savvy buyers from discovering genuine bargains. An insurance write-off simply means an insurer has deemed a damaged vehicle uneconomical to repair, typically when repair costs exceed around 50% of its market value. It's a business decision, not always a verdict on a car's roadworthiness.

Many written-off vehicles, particularly those classified as Category S or Category N, are safely and legally returned to the road after professional repairs. This guide aims to demystify these categories, providing the knowledge to distinguish a valuable opportunity from a potential money pit. Understanding the nuances here can unlock significant savings on a used car purchase.

The UK operates a formal system for classifying damaged vehicles, governed by the Association of British Insurers (ABI). This system outlines four main categories: A, B, S, and N. Each category signifies a different level of damage severity and dictates the vehicle's future. For the discerning used car buyer, focusing solely on Category S and N is paramount.

Note: The difference between a minor repair and a total loss is often a careful calculation of economics rather than sheer damage, opening doors for buyers.

This article will guide you through each classification, equipping you with the essential checks and insights needed to navigate this specific segment of the used car market with confidence.

Understanding the distinction between Cat S and Cat N is crucial for any used car buyer to identify genuine bargains while avoiding dangerous or costly mistakes.

The UK's Vehicle Write-Off Categories Explained

Navigating the used car market requires understanding the UK's formal insurance write-off categories. This classification system isn't just bureaucratic; it's a critical indicator of a vehicle's past, dictating whether it can ever legally return to the road. The hierarchy clearly defines the extent of damage, making only two categories viable for purchase and repair.

Here

in an infographic:

| Category | Damage Type | Roadworthy? | Parts Salvageable? | Buyer Consideration |

|---|---|---|---|---|

| A | Scrap only; severe damage | Never | No | None |

| B | Break for parts; significant damage to chassis | Never | Yes | Only for parts |

| S | Structural damage; repairable | Yes (Post-repair & re-registration) | Yes | Yes (with caution) |

| N | Non-structural damage; repairable | Yes (Post-repair) | Yes | Yes |

Category A: Scrap Only

This is the most severe classification. A Category A vehicle has suffered extreme damage, rendering it unsafe even for parts. The Association of British Insurers (ABI) Salvage Code mandates that these cars must be crushed entirely. No components can be salvaged or reused in another vehicle, ensuring they never pose a risk.

Category B: Break for Parts

While also unable to return to the road, Category B indicates slightly less severe damage than Category A. The vehicle's body shell must be destroyed, preventing it from ever being driven again. However, specific components, such as engines, gearboxes, or interior fittings, can be legitimately salvaged and reused in other vehicles. Major online platforms like Autotrader will not allow Cat A or B cars to be advertised for sale.

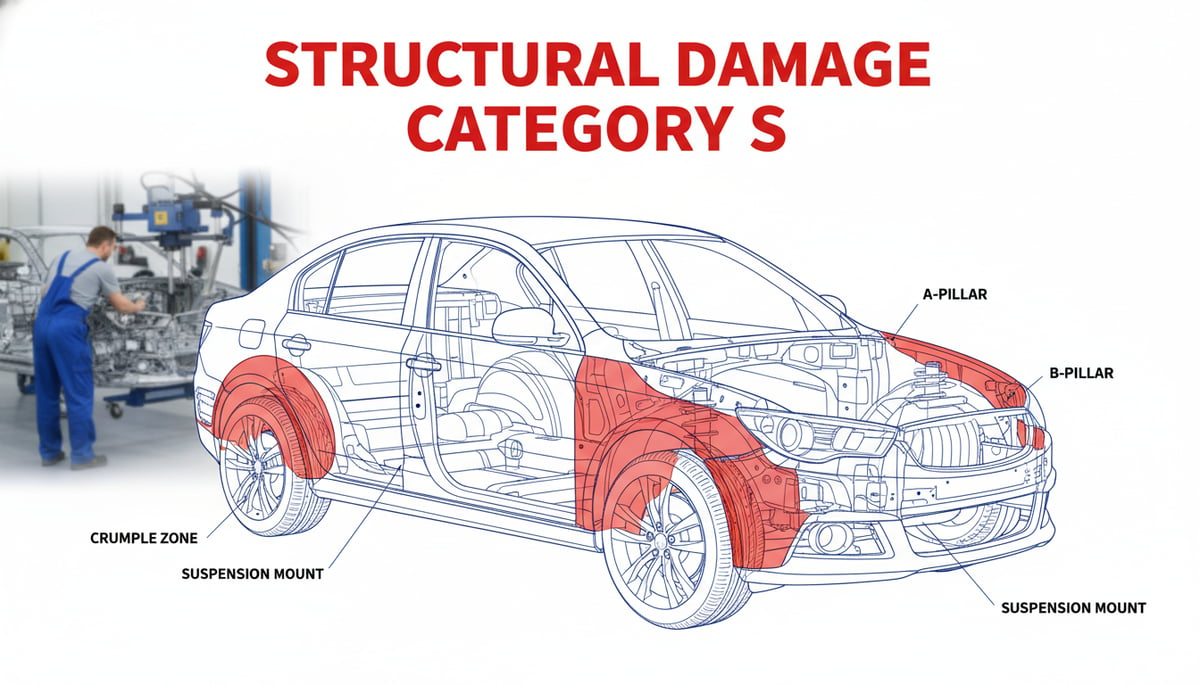

Category S: Structural Damage

This category signifies that the vehicle has suffered structural damage to its frame or chassis. While serious, this damage is deemed repairable. These repairs, however, require specialized professional work to ensure the vehicle's structural integrity and safety systems are fully restored. After proper repair and re-registration, Cat S cars can legally return to the road.

Category N: Non-Structural Damage

Category N represents non-structural damage, meaning the vehicle's core safety structure remains intact. This damage can range from purely cosmetic issues, like dents and scratches, to more significant problems affecting electrical systems, braking, or steering, but without compromising the chassis. These vehicles are also repairable and can be returned to the road after appropriate fixes.

The write-off classification system is a clear hierarchy of damage, with only Category S and N vehicles being legally permitted to return to the road after repair.

Deep Dive: Understanding Category S (Structural Damage)

When considering a used car, a Category S classification demands particular attention. This designation indicates that the vehicle has sustained significant damage to its fundamental structure – the chassis or frame. Unlike cosmetic repairs, addressing structural integrity is crucial for a vehicle's safety, handling, and long-term durability. It signifies more than just dents; it impacts the car's core protective cage.

Structural damage typically affects areas like the vehicle's crumple zones, pillars (A, B, C), the floor pan, and suspension mounting points. Examples include a bent chassis from a severe head-on or side collision, damage to the B-pillar (the structural post between the front and rear doors) from an impact, or compromised mounting points for critical suspension components. Such damage can profoundly alter how a vehicle absorbs impact in future collisions or handles on the road.

Repairs for a Cat S car are not for the amateur mechanic. They must be performed by qualified professionals using specialized equipment, such as jig alignment systems, to ensure the chassis is restored to factory specifications. This meticulous process ensures the vehicle's structural integrity is fully recovered and its safety systems – including airbags and pre-tensioners – function as intended. Without proper repair, the car's crashworthiness and handling characteristics could be severely compromised.

Crucially, a repaired Category S car must undergo a specific administrative process before it can legally be driven on UK roads. The insurer must submit Form V23 to the DVLA to notify them of the write-off. Although the DVLA no longer requires a vehicle identity check (VIC) for Cat S cars as they did under the old Category C system, the write-off status remains permanently on the vehicle's history. It is essential for buyers to check the vehicle's paperwork to ensure it has been correctly re-registered and its structural integrity certified, where applicable, by the repairer. This change in classification from the old Cat C system in 2017 was specifically designed to focus on the type of damage rather than just the repair cost, giving buyers a clearer picture.

Note: Always verify the vehicle's registration documents and perform a comprehensive history check to confirm a Cat S vehicle has been correctly repaired and declared fit for road use.

A Category S classification indicates serious but repairable damage to the vehicle's core safety structure, necessitating professional repair and mandatory DVLA re-registration.

Decoding Category N: More Than Just Cosmetic Damage

When a vehicle is involved in an incident, its damage assessment can lead to classifications like Category N, often mistakenly associated solely with minor cosmetic issues. While it's true that a Category N car—standing for non-structural damage—has not sustained harm to its fundamental frame or chassis, this doesn't imply negligible repairs. The core structure remains intact, a key differentiator from Category S vehicles.

However, assuming Cat N only covers 'scratches and dents' overlooks the complexity modern vehicles embody. Damage can indeed be superficial, such as bumper scuffs or minor bodywork. Yet, a Category N assessment frequently encompasses more intricate, and often costly, underlying problems. For instance, issues might arise with crucial wiring looms, complex electronic control units (ECUs), or sensor systems that govern various vehicle functions.

Note: The AA defines non-structural damage as including issues with electrical systems or non-critical engine parts. This highlights that "non-structural" doesn't equate to "non-essential." The system itself was updated from the older Cat D classification precisely to better reflect the diverse nature of damage in today's technologically advanced cars.

Consider the potential for damage to vital components like braking systems, steering mechanisms, or suspension parts, all of which fall under the 'non-structural' umbrella if the chassis is unaffected. Water damage, a common culprit, can seep into a vehicle's interior, corrupting electrics and upholstery without compromising the car's structural integrity. Such issues, while not affecting the chassis, demand significant and expert intervention. Non-structural damage could be to the brakes, steering, electrics, safety-features, or even just cosmetic damage. Water damage that has affected the electrics or interior but hasn’t damaged the frame is a prime example.

A significant practical difference for buyers is that unlike Cat S cars, a repaired Category N vehicle does not need to be re-registered with the DVLA. This is because its core structure, the foundation of its roadworthiness, was never compromised, meaning no DVLA notification is needed for Category N cars.

Ultimately, understanding Category N means looking beyond surface-level damage. It signifies that while the vehicle's bones are sound, its nervous system or vital organs might have suffered significant, repairable trauma.

A Category N classification should prompt a thorough investigation into the specific nature of the damage and the quality of its subsequent repair.

Should You Buy a Cat S or Cat N Car? A Buyer's Checklist

Considering a Category S or N car often begins with the allure of a significantly lower purchase price compared to an equivalent non-written-off vehicle. This financial incentive can be substantial, making these cars an attractive option for budget-conscious buyers. However, this potential saving comes with inherent risks, primarily concerning the quality of repairs, implications for insurance, and a typically reduced resale value down the line. It's a balance between opportunity and rigorous scrutiny.

The key risks associated with purchasing a previously written-off vehicle are multifaceted. Substandard repairs can compromise the car's safety, potentially affecting its handling, braking, or structural integrity (in the case of Cat S). Furthermore, obtaining insurance can be more challenging and expensive, a point we'll explore further. When it comes time to sell, a Cat S or N designation will almost certainly mean a substantially lower resale value, reflecting market perception and the car's history. Expert advice from Car.co.uk suggests it's often a 'motor trader's game,' highlighting the expertise required to navigate these purchases successfully, especially for private buyers.

To navigate these waters effectively, a robust due diligence process is indispensable. Here’s your essential checklist:

- Get a full vehicle history check: Utilise services like an HPI check or a comprehensive report from chatmot.co.uk to confirm the car's official write-off status and uncover any other undisclosed issues. This is your foundational step.

- Demand documentary evidence of damage and repairs: Insist on seeing photos of the original damage and comprehensive invoices for all parts and labour used in the repair. This transparency is crucial to verify the extent of the damage and the quality of the work.

- Commission a professional third-party inspection: Engage a reputable service, such as The AA, to perform a pre-purchase inspection. An independent expert can assess the quality of repairs, identify any lingering issues, and confirm the car's overall roadworthiness. All major automotive advice sites (Autotrader, The AA) strongly recommend history checks and inspections.

- Obtain insurance quotes before you commit: Do not assume standard insurance rates or availability. Contact multiple insurers, openly disclosing the car's Category status, to understand potential premiums and coverage options. This step can prevent significant unexpected costs.

- For Cat S cars, verify DVLA re-registration in the V5C logbook: A Category S vehicle must be professionally repaired and re-inspected before it can be legally returned to the road. Ensure the V5C logbook clearly states its re-registered status. No such re-registration is required for Cat N cars.

While Cat S and Cat N cars can be a lot cheaper to buy, they will also be worth less when you come to sell them. Always make sure the car has been properly repaired and ask to see documentary evidence. Consider having a third-party inspection done to give it the all-clear (Motorway.co.uk, 2024). Taking these steps meticulously can transform a risky purchase into a well-informed decision.

Buying a Cat S or N car requires diligent research and professional inspection to ensure safety and long-term value.

Insuring a Cat S or Cat N Car: What You Must Know

Navigating insurance for a car previously written off as Category S or N introduces specific challenges and requirements that prospective buyers must fully understand. This isn't merely a formality; it significantly impacts both cost and coverage. Insurers view repaired write-offs as carrying a higher inherent risk compared to vehicles with clean histories. This perception directly translates into higher premiums for the policyholder.

The reason for increased premiums stems from the insurer's assessment that even after repairs, there's a higher potential for residual issues, or future claims related to the original damage. Furthermore, some insurance providers may refuse to offer comprehensive cover for Cat S or N cars, limiting options to third-party, fire, and theft. In more extreme cases, certain insurers might decline to cover these vehicles altogether, making it essential to shop around diligently. Multiple sources (Autotrader, The AA, Car.co.uk) confirm higher premiums and the potential for refusal of cover.

Note: It is a legal requirement to disclose the car's write-off status to your insurer. Failure to do so is considered insurance fraud and will void your policy, leaving you without cover in the event of an accident. Omitting information from advertising or sales documentation, especially for a vehicle's history, is a criminal offence.

This disclosure requirement is non-negotiable. When seeking quotes, you must explicitly inform potential insurers about the vehicle's Category S or N classification. Failure to provide this critical information could lead to your policy being invalidated, meaning any claim you make would be rejected, and you could face legal repercussions for insurance fraud.

Before committing to a purchase, always shop around and get multiple insurance quotes specifically for the Category S or N vehicle you are considering. This proactive step helps you gauge the actual cost of ownership beyond the purchase price and avoid any unwelcome surprises. Premiums may be higher, and not all insurers may cover it, advising to confirm with insurers before buying a Cat N car (What Car?, 2024). Securing suitable cover is as crucial as the car purchase itself.

Full, upfront disclosure of a Cat S or N car's history to insurers is legally mandatory and impacts coverage and premiums.

This guide has aimed to clarify the complexities surrounding Cat S and Cat N vehicles, equipping UK buyers with the knowledge needed to approach these unique market segments with confidence. Understanding these insurance write-off categories is the first step towards making an informed decision, differentiating between potential bargains and costly mistakes.

Here are the key takeaways from our discussion:

- Category S (Structural Damage): These vehicles have sustained damage to their chassis or frame, requiring professional repair to restore their structural integrity and ensure roadworthiness. A comprehensive understanding of the repair work undertaken is crucial.

- Category N (Non-Structural Damage): While not impacting the vehicle's fundamental structure, Cat N damage can still involve critical components like steering, braking, or electrics. Thorough checks are essential to identify and confirm quality repairs, preventing future issues.

- Due Diligence is Non-Negotiable: For both categories, independent inspections by qualified mechanics, combined with exhaustive vehicle history checks, are paramount. Always verify the quality of repairs and ensure all damage has been properly addressed before committing to a purchase.

Ultimately, buying a Cat S or Cat N car can present an opportunity for significant savings, but only when approached with meticulous care and verification.

To navigate these purchases successfully, empower your decision-making with data-driven insights. Accessing comprehensive vehicle history reports and leveraging advanced analytics can provide clarity on past damages, repair quality, and overall vehicle health. This essential step ensures you make a fully informed choice, avoiding unforeseen issues and granting you peace of mind with your next vehicle.

Tags

Related Articles

Beyond Sunscreen: A Practical Guide to Sun-Protective Clothing

Safety First: Debunking Plastic Surgery Accident Myths